Tax season brings its fair share of challenges—huge piles of paperwork, tight deadlines, and the pressure to stay organized for clients. Staying organized doesn’t have to be overwhelming. By keeping accurate records, saving receipts, proper categorization, and more —you’ll be well-prepared to take on tax season. There’s no better place to start your organization journey than with the right folder.

Your CPA tax folders aren’t just any regular folder. They represent your business, the quality of the work you do and keep you organized during tax season. That’s why you want to make sure you’re choosing the best one possible.

Why Document Organization Matters for Tax Professionals

For tax professionals, staying organized is more than just a matter of convenience—it’s essential for meeting deadlines, ensuring accuracy, and maintaining a professional and classy image. During tax season, you’ll find that the more efficient your document management is, the smoother your process will go.

Nicky's® CPA Version 10 Tax Return Folders are known for streamlining the tax preparation process. But, with so many other options on the market, it’s important to understand the key differences between high-quality options like Nicky’s® CPA Folder and generic alternatives.

Key Differences Between Nicky’s® CPA Folder & Generic Options

When presenting your client with paper documents, it's important to use a high-quality folder made from quality materials that shows your commitment to keeping their papers organized and professional. Here’s how Nicky’s® CPA Folder can help you stand out:

High Quality

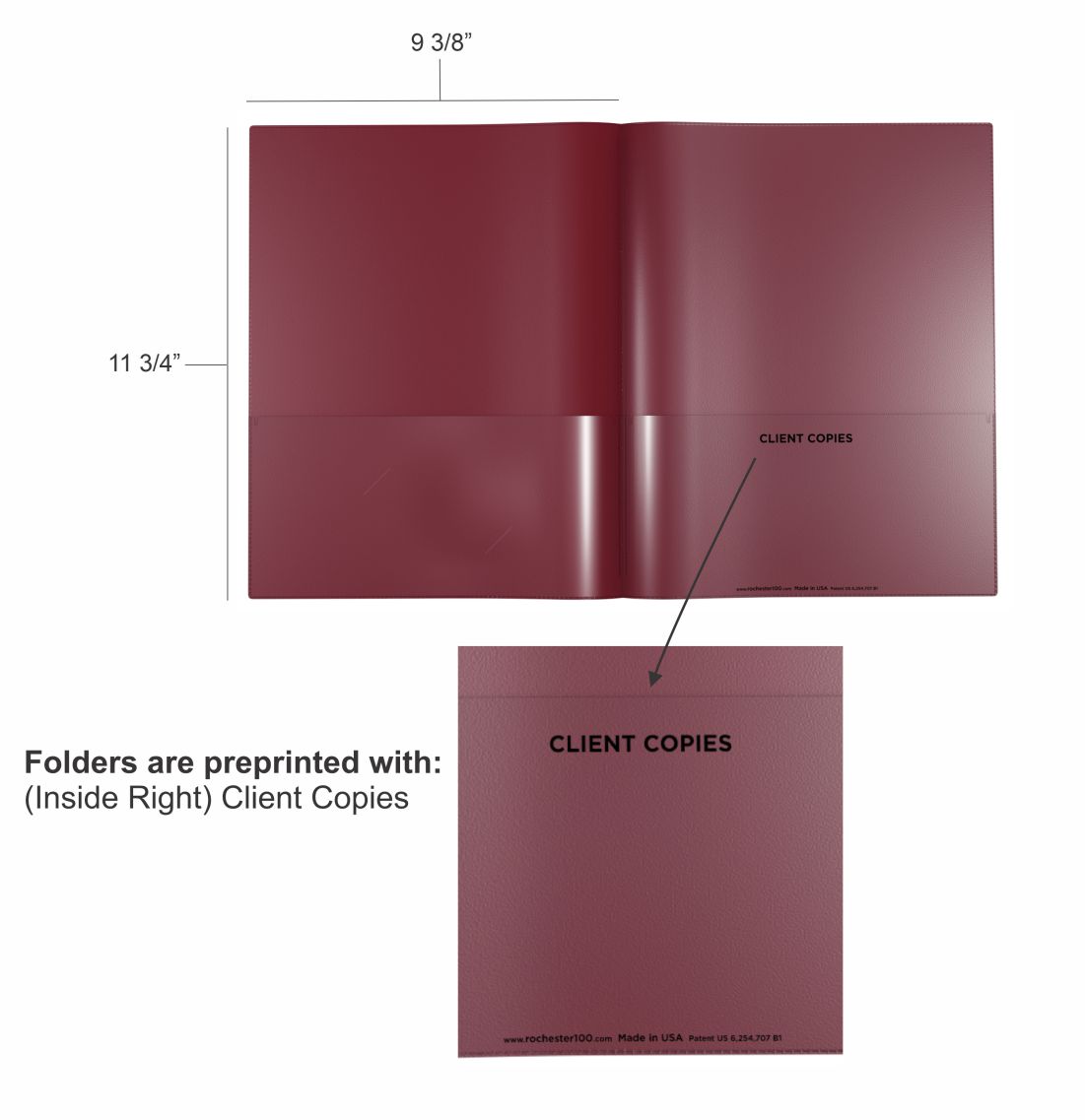

Rochester 100®'s Nicky’s® CPA Folders are made with only high-quality materials, making this a permanent investment season after season. In contrast, other tax return folders are made from paper-based materials, which can lead to tears and bends, making them look less valuable and leaving your important documents unprotected. Investing in Nicky’s® CPA Folders means you’re choosing a durable, reliable folder that will hold up over time and maintain a professional appearance for you as a tax professional.

Customization Features

At Rochester 100®, our Nicky’s® folders are customizable, allowing you to tailor the folder to your client's needs, make a strong impression, and create an unforgettable professional image. Clients appreciate the personalized presentation of their tax return documents, which reflects positively on you as a tax professional.

Functionality

Nicky’s® Tax Return Folders are designed with reinforced edges, and easy-to-use pockets to keep all of your client’s important tax documents in place. A lot of generic tax return folders typically lack these functional features, leaving you to deal with cluttered or disorganized paperwork.

Other Tools to Boost Efficiency for Tax Professionals

Picking a high-quality tax return folder for clients is a great start to enhancing your efficiency, but it’s just one of the many tools tax professionals can use to help them during tax season. Here are two important tools to consider:

- Online Tax Return Folders for Clients

Although most tax returns are filed electronically, providing clients with a printed copy in a professional folder shows them that they are valued and your attention to detail goes beyond the digital process. At Rochester 100® our Nicky's® CPA Version 11 Online Electronic Tax Return Folder is the perfect tool for tax professionals who want to present their clients with printed copies of their tax returns in a professional and organized manner.

- Communication Tools

Lastly, having a good communication system is key during tax season. Email platforms, scheduling tools, and secure client portals all help you stay in touch with clients and keep them informed about the status of their returns. This can improve your client relationships and help you stay on top of your heavy workload.

Order Your Nicky’s® CPA Folders Today!

By investing in Nicky’s® CPA Tax Return Folder, you’re not just keeping your clients' documents organized, but you're creating a lasting impression on your clients and standing out as a trusted and detail-oriented tax professional.